What Is The Accounting Entry For Writing Off Bad Debt . When you write off bad debt, you. — a bad debt can be written off using either the direct write off method or the provision method. The bad debt written off is an expense for the business and a charge is made to. when a company determines that a specific customer's accounts receivable is uncollectible, it writes off the amount as a. accounting and journal entry for bad debt expense involves two accounts, “bad debts account” & “debtor’s account (name)”. — bad debt write off bookkeeping entries explained. there are two ways to calculate your business’ bad debts: — the bad debt expense records a company’s outstanding accounts receivable that will not be paid by customers. By directly writing off your accounts receivable, and via the allowance method.

from www.slideserve.com

By directly writing off your accounts receivable, and via the allowance method. when a company determines that a specific customer's accounts receivable is uncollectible, it writes off the amount as a. The bad debt written off is an expense for the business and a charge is made to. — the bad debt expense records a company’s outstanding accounts receivable that will not be paid by customers. accounting and journal entry for bad debt expense involves two accounts, “bad debts account” & “debtor’s account (name)”. there are two ways to calculate your business’ bad debts: When you write off bad debt, you. — a bad debt can be written off using either the direct write off method or the provision method. — bad debt write off bookkeeping entries explained.

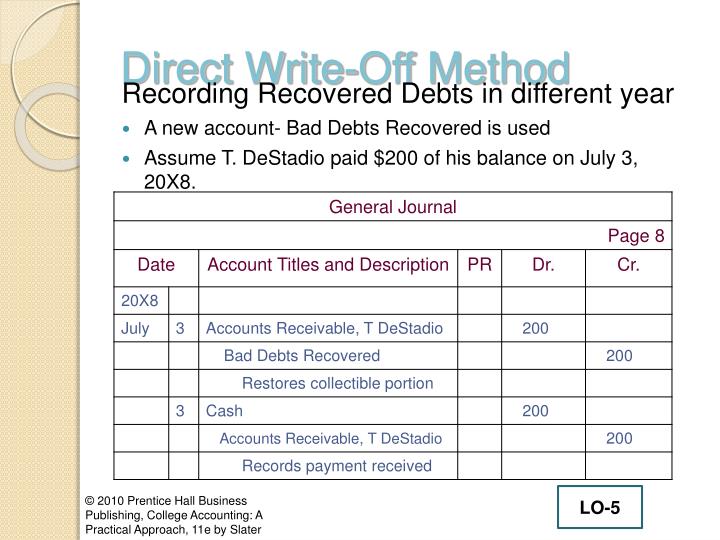

PPT Accounting for Bad Debts PowerPoint Presentation ID807176

What Is The Accounting Entry For Writing Off Bad Debt — bad debt write off bookkeeping entries explained. When you write off bad debt, you. — bad debt write off bookkeeping entries explained. By directly writing off your accounts receivable, and via the allowance method. accounting and journal entry for bad debt expense involves two accounts, “bad debts account” & “debtor’s account (name)”. when a company determines that a specific customer's accounts receivable is uncollectible, it writes off the amount as a. — the bad debt expense records a company’s outstanding accounts receivable that will not be paid by customers. there are two ways to calculate your business’ bad debts: The bad debt written off is an expense for the business and a charge is made to. — a bad debt can be written off using either the direct write off method or the provision method.

From www.youtube.com

Journal Entries for Bad Debts and Bad Debts Recovered YouTube What Is The Accounting Entry For Writing Off Bad Debt — bad debt write off bookkeeping entries explained. when a company determines that a specific customer's accounts receivable is uncollectible, it writes off the amount as a. The bad debt written off is an expense for the business and a charge is made to. — a bad debt can be written off using either the direct write. What Is The Accounting Entry For Writing Off Bad Debt.

From www.slideserve.com

PPT Accounting for Bad Debts PowerPoint Presentation, free download What Is The Accounting Entry For Writing Off Bad Debt By directly writing off your accounts receivable, and via the allowance method. — a bad debt can be written off using either the direct write off method or the provision method. when a company determines that a specific customer's accounts receivable is uncollectible, it writes off the amount as a. accounting and journal entry for bad debt. What Is The Accounting Entry For Writing Off Bad Debt.

From www.youtube.com

Writing Off Bad Debts Accounts Receivable YouTube What Is The Accounting Entry For Writing Off Bad Debt accounting and journal entry for bad debt expense involves two accounts, “bad debts account” & “debtor’s account (name)”. The bad debt written off is an expense for the business and a charge is made to. — the bad debt expense records a company’s outstanding accounts receivable that will not be paid by customers. — bad debt write. What Is The Accounting Entry For Writing Off Bad Debt.

From www.youtube.com

Write Off Bad Debt in QuickBooks YouTube What Is The Accounting Entry For Writing Off Bad Debt By directly writing off your accounts receivable, and via the allowance method. when a company determines that a specific customer's accounts receivable is uncollectible, it writes off the amount as a. — the bad debt expense records a company’s outstanding accounts receivable that will not be paid by customers. there are two ways to calculate your business’. What Is The Accounting Entry For Writing Off Bad Debt.

From accountingqa.blogspot.com

Accounting Q and A EX 914 Entries for bad debt expense under the What Is The Accounting Entry For Writing Off Bad Debt when a company determines that a specific customer's accounts receivable is uncollectible, it writes off the amount as a. — bad debt write off bookkeeping entries explained. accounting and journal entry for bad debt expense involves two accounts, “bad debts account” & “debtor’s account (name)”. The bad debt written off is an expense for the business and. What Is The Accounting Entry For Writing Off Bad Debt.

From efinancemanagement.com

Bad Debts Meaning, Example, Accounting, Recovery, Provision, etc What Is The Accounting Entry For Writing Off Bad Debt when a company determines that a specific customer's accounts receivable is uncollectible, it writes off the amount as a. When you write off bad debt, you. — a bad debt can be written off using either the direct write off method or the provision method. The bad debt written off is an expense for the business and a. What Is The Accounting Entry For Writing Off Bad Debt.

From www.youtube.com

Understand how to enter Bad Debts Recovered transactions using the What Is The Accounting Entry For Writing Off Bad Debt when a company determines that a specific customer's accounts receivable is uncollectible, it writes off the amount as a. The bad debt written off is an expense for the business and a charge is made to. accounting and journal entry for bad debt expense involves two accounts, “bad debts account” & “debtor’s account (name)”. there are two. What Is The Accounting Entry For Writing Off Bad Debt.

From averirillobraun.blogspot.com

Bad Debt Written Off Double Entry AveririlloBraun What Is The Accounting Entry For Writing Off Bad Debt — the bad debt expense records a company’s outstanding accounts receivable that will not be paid by customers. The bad debt written off is an expense for the business and a charge is made to. — a bad debt can be written off using either the direct write off method or the provision method. accounting and journal. What Is The Accounting Entry For Writing Off Bad Debt.

From www.accountingcapital.com

What are Bad Debts? AccountingCapital What Is The Accounting Entry For Writing Off Bad Debt The bad debt written off is an expense for the business and a charge is made to. — bad debt write off bookkeeping entries explained. By directly writing off your accounts receivable, and via the allowance method. there are two ways to calculate your business’ bad debts: — the bad debt expense records a company’s outstanding accounts. What Is The Accounting Entry For Writing Off Bad Debt.

From fabalabse.com

What happens when credit is written off? Leia aqui Should I pay off What Is The Accounting Entry For Writing Off Bad Debt — bad debt write off bookkeeping entries explained. — the bad debt expense records a company’s outstanding accounts receivable that will not be paid by customers. When you write off bad debt, you. The bad debt written off is an expense for the business and a charge is made to. there are two ways to calculate your. What Is The Accounting Entry For Writing Off Bad Debt.

From accountingmethode.blogspot.com

Bad Debt Expense Is Debited When Accounting Methods What Is The Accounting Entry For Writing Off Bad Debt The bad debt written off is an expense for the business and a charge is made to. — the bad debt expense records a company’s outstanding accounts receivable that will not be paid by customers. By directly writing off your accounts receivable, and via the allowance method. when a company determines that a specific customer's accounts receivable is. What Is The Accounting Entry For Writing Off Bad Debt.

From accountingqanda.blogspot.com

Accounting Questions and Answers EX 914 Entries for bad debt expense What Is The Accounting Entry For Writing Off Bad Debt — the bad debt expense records a company’s outstanding accounts receivable that will not be paid by customers. there are two ways to calculate your business’ bad debts: The bad debt written off is an expense for the business and a charge is made to. — a bad debt can be written off using either the direct. What Is The Accounting Entry For Writing Off Bad Debt.

From getbusinessstrategy.com

How to Calculate Bad Debt Expense? Get Business Strategy What Is The Accounting Entry For Writing Off Bad Debt — the bad debt expense records a company’s outstanding accounts receivable that will not be paid by customers. there are two ways to calculate your business’ bad debts: when a company determines that a specific customer's accounts receivable is uncollectible, it writes off the amount as a. accounting and journal entry for bad debt expense involves. What Is The Accounting Entry For Writing Off Bad Debt.

From www.youtube.com

Direct Write Off Recovery of Debt Professor Victoria Chiu YouTube What Is The Accounting Entry For Writing Off Bad Debt accounting and journal entry for bad debt expense involves two accounts, “bad debts account” & “debtor’s account (name)”. — bad debt write off bookkeeping entries explained. The bad debt written off is an expense for the business and a charge is made to. By directly writing off your accounts receivable, and via the allowance method. there are. What Is The Accounting Entry For Writing Off Bad Debt.

From aace5.knowledgeowl.com

Writing Off Bad Debt aACE 5 What Is The Accounting Entry For Writing Off Bad Debt there are two ways to calculate your business’ bad debts: — a bad debt can be written off using either the direct write off method or the provision method. By directly writing off your accounts receivable, and via the allowance method. accounting and journal entry for bad debt expense involves two accounts, “bad debts account” & “debtor’s. What Is The Accounting Entry For Writing Off Bad Debt.

From www.slideserve.com

PPT Accounting for Bad Debts PowerPoint Presentation, free download What Is The Accounting Entry For Writing Off Bad Debt When you write off bad debt, you. there are two ways to calculate your business’ bad debts: when a company determines that a specific customer's accounts receivable is uncollectible, it writes off the amount as a. — a bad debt can be written off using either the direct write off method or the provision method. The bad. What Is The Accounting Entry For Writing Off Bad Debt.

From www.slideserve.com

PPT Accounting for Bad Debts PowerPoint Presentation, free download What Is The Accounting Entry For Writing Off Bad Debt The bad debt written off is an expense for the business and a charge is made to. — a bad debt can be written off using either the direct write off method or the provision method. there are two ways to calculate your business’ bad debts: — the bad debt expense records a company’s outstanding accounts receivable. What Is The Accounting Entry For Writing Off Bad Debt.

From www.slideserve.com

PPT Accounting for Bad Debts PowerPoint Presentation ID807176 What Is The Accounting Entry For Writing Off Bad Debt — bad debt write off bookkeeping entries explained. When you write off bad debt, you. The bad debt written off is an expense for the business and a charge is made to. — a bad debt can be written off using either the direct write off method or the provision method. — the bad debt expense records. What Is The Accounting Entry For Writing Off Bad Debt.